Fraud & Security

If you think you have been a victim of identity theft or you have had your card stolen or lost, contact Advancial immediately.

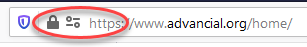

Protecting your privacy and keeping your data secure is our number one priority.

Here's how Advancial keeps you and your money safe:

Know the Red Flags

Red flags: The representative is asking for personal information. Advancial will never ask for your PIN or Social Security Number over the phone.

Red flags: Government agencies communicate through official channels and do not ask for your personal information over the phone.

Red flags: The company calls without you initiating contact and requests access to your computer. Legitimate companies do not operate in this way.

Red flags: The communication is via social media which means you cannot confirm the identity of the person on the other end. Always contact that person directly using the phone number or email you have used before in order to verify the message.

Red flags: Asking for the difference in a way that you cannot cancel once it is sent. Fraudsters commonly cancel the transaction, leaving you with money that you sent that cannot be reclaimed.