Telephone Banking

Our Voice Assistant is ready to help around the clock! Call any time 800.322.2709

Advancial's Voice Assistant is ready to help 24/7/365

Access your accounts 24-hours a day from your home, office or cell phone by calling us at 800.322.2709, or 1+ 214.880.9585 for international calling. Just say what you want to do, and our Voice Assistant can help with a variety of banking tasks.

Make a payment

Check account balances

Transfer funds between accounts

Verify deposits and withdrawals

Inquire about current rates

Reorder checks

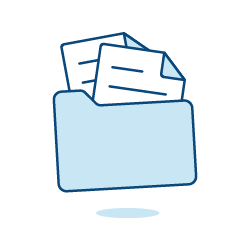

Member Service Center

Member Service Representatives are ready to help with all of your financial needs. You can call, email, send regular mail, or use text or even video chat by clicking the tabs at the bottom right of your screen!

800.322.2709

Monday-Friday: 7:30 a.m. - 6:30 p.m. CST

Saturday: 9:00 a.m. – 1:00 p.m. CST

Sunday: CLOSED

Apply for Membership

Open an Account

Change Account Information

Submit Forms

Frequently Asked Questions