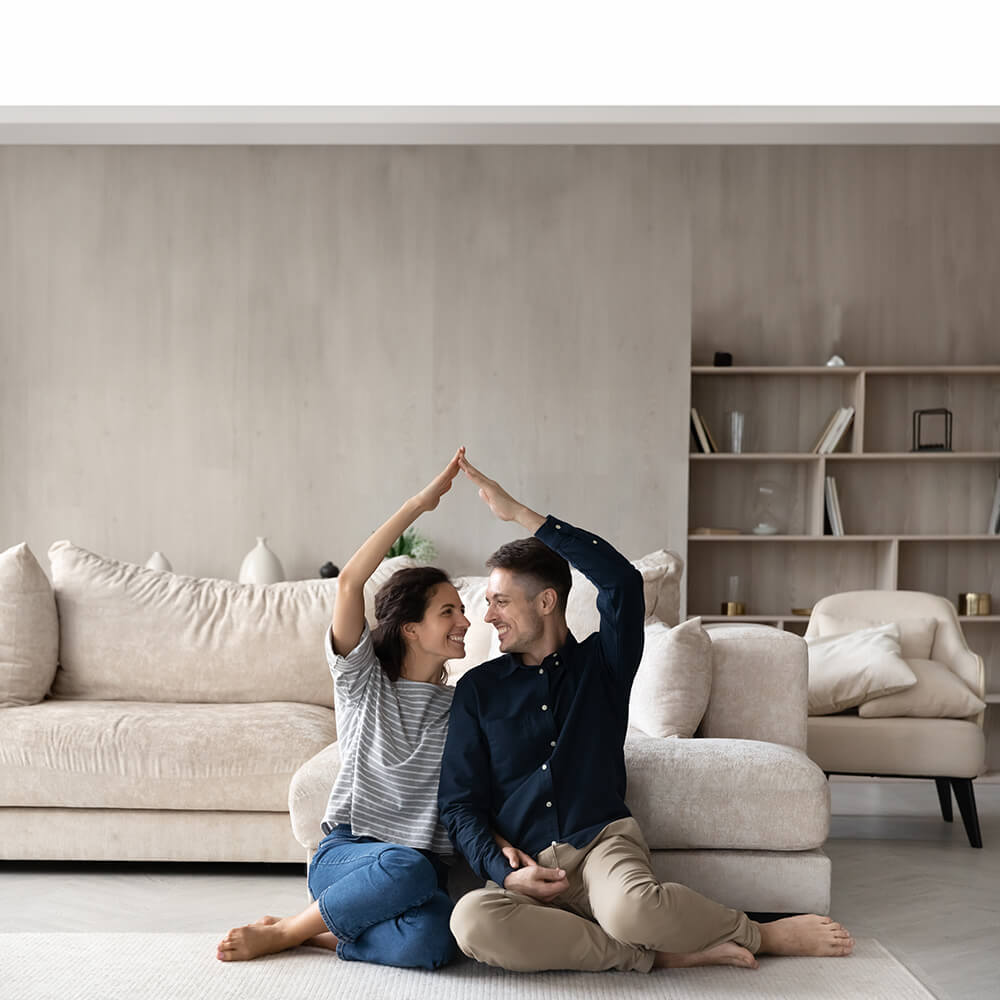

ARM Features and Benefits

An Adjustable-Rate Mortgage (ARM) is ideal if you initially want lower monthly payments. After the initial loan period, your rates can adjust based on several factors. An ARM is best suited for borrowers who plan to own their home for a short period of time or have a significantly larger income in the future.

Even if you already have an ARM, there may be an opportunity to refinance your loan for a better rate.

Available in 5/6, 7/6 and 10/6 terms

Lower monthly payments

Low closing costs

Online tax statements

Mortgage Calculators

- Am I better off renting?

- Debt-to-income ratio

- How much can I afford?

- How much will I make by selling my current home?

- How much will my adjustable-rate mortgage payments be?

- Should I make biweekly or monthly payments?

- Should I refinance my mortgage?

- What will my mortgage payments be?

- Which mortgage loan is better?

Tools & Resources

Application Checklist

Home Insurance

Frequently Asked Questions about Mortgages

**Loans over a certain amount are called jumbo loans. In most states, mortgage loans on a single-family residence greater than $806,500 are jumbo loans. In certain high-cost areas, including Alaska and Hawaii, a single-family mortgage loan over $1,209,750 is considered a jumbo loan.