Card Updater

What is Card Updater?

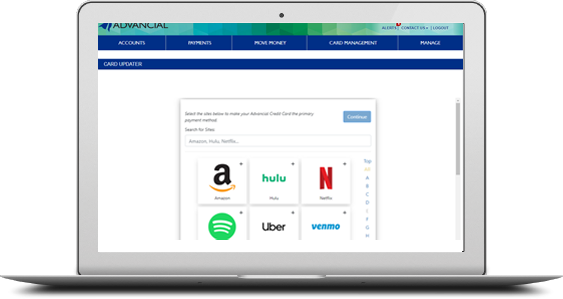

Advancial's Card Updater service provides a fast and secure way to update your credit or debit card information across all of your favorite sites at once.

How Do I Use It?

To access Card Updater:

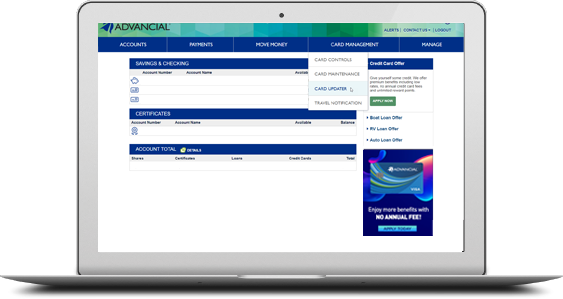

- Log in to cuAnywhere® Online Banking

- Select Card Management > Card Updater

Yes, Card Updater is secure. None of your information is stored.

None of your personally identifiable information is stored during or upon completion of updating your sites. Your sensitive information is securely and permanently discarded once it is placed on the intended account you have chosen.

Frequently Asked Questions about Card Updater

This safely and securely updates your preferred payment method on the selected sites, saving you time and energy from going to each individual site and entering your payment information.