Dinero Teens: Check-Writing 101

In an era of digital payments, you may not regularly need to write a check to complete a purchase. But at some point, you will likely want or need to write a check because it’s the best option available, such as when you are:

How to Write a Check

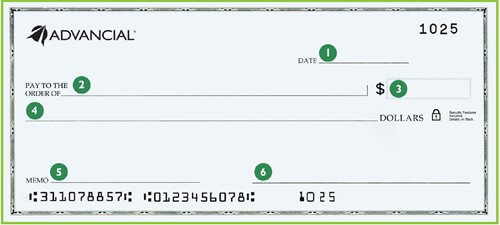

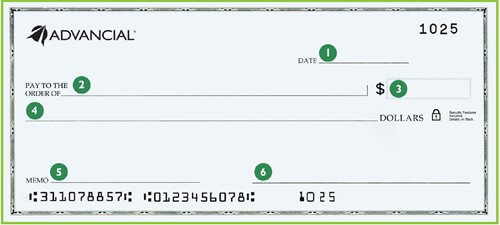

With your Ultimate Checking account, you’ll receive a deck of paper checks with your name printed in the upper left of each check. As shown in the accompanying graphic, there are seven simple steps for writing a check.

That’s it! If you have any questions about how to properly write a check, simply call or stop by your local Advancial branch.

- Paying for a service such as plumbing or other home repairs

- Making a charitable donation

- Lacking cash on hand or don’t have a credit or debit card

- Shopping at a small business that doesn’t accept digital payments

- Seeking to trace payment for an important transaction

- Gifting money to someone

How to Write a Check

With your Ultimate Checking account, you’ll receive a deck of paper checks with your name printed in the upper left of each check. As shown in the accompanying graphic, there are seven simple steps for writing a check.

- Enter the date in the line in the upper right corner. Be sure to write the month, day and year, either as “June 6, 2023” or “6/6/23”.

- Write the check recipient’s name in the “Pay to the order of” line on the left. Be sure to get the spelling of the check recipient right.

- Enter a dollar and cents amount, using numerals only, in the blank box with a dollar sign. Be sure to write out both dollar numerals and cents numerals, and put a decimal point between the dollar amount and cents amount. For example: “23.00”.

- Write out the dollar amount of your purchase using words and a fraction in the line right below the “Pay to the order of” line. Write the dollar amount first. For example: “Twenty-three”. Then, insert the word “and” followed by the cents amount, written as a fraction divided by 100. For example: zero cents would be shown as “00/100”. Your complete line should then read: “Twenty-three and 00/100”. If there’s any room remaining on this line afterward, draw a straight line to the end of the blank.

- Write a reminder to yourself of what you’ve purchased in the “For” (or “Memo”) line in the lower left of the check. This will help you remember what you used this check to buy.

- Sign your full name on the signature line, in the lower right of the check. Use your given name, not a nickname, as this is a formal document. For example: “Anthony” not “Tony”.

- (Not pictured) Write a record of your check, including the check number, date, transaction description, and payment amount, in the check registry section of your checkbook. This will help you keep track of your checks written.

That’s it! If you have any questions about how to properly write a check, simply call or stop by your local Advancial branch.