See how you save when you switch.

As your local credit union, you’ll have access to the great rates, fewer fees and exceptional service that make Advancial a smarter and better way to bank.

Like to Save? We'll Save You the Time.

If you're constantly searching for the best value for the products or services you purchase, make sure you're also taking a look at the best banking options available to you! You'd be surprised how much money you'd be able to save by just switching to a more well-rounded banking experience.

Ultimate Checking

2 At TTCU Federal Credit Union, receive Early Pay with approved credit. Some restrictions apply. Direct deposit and earlier availability of funds are subject to payer’s support of the feature and timing of payer’s submission of deposits. We generally post such deposits on the day they are received which may be up to two days earlier than the payer’s scheduled payment date. Exceptions may apply.

2 At First Fidelity Bank, the timing is dependent upon when your payroll provider submits their payroll file. As soon as we receive the file, we will post the funds within two business days of scheduled payday, but we do not have control over when the file is sent. For many companies, the date the file is sent may vary by a day or two from pay period to pay period based on holiday or weekend schedules. For some pay periods, your direct deposit may show up earlier than others, but it will never be later than your regular payday.

2 At MidFirst Bank, Early Pay requires eligible direct deposit to your MidFirst account. Direct deposits eligible for Early Pay include transactions that MidFirst can reasonably determine as employment compensation or government benefit payments. When a payer, such as an employer, submits payment files to MidFirst before the scheduled payment date, MidFirst may generally make funds available up to two days earlier than the scheduled payment date. Timing of access to these funds is dependent on the payer’s payment instructions, how the transaction is coded, and the timing of submission of payment files to MidFirst from the payer. Timing of available funds may vary between payment periods. MidFirst does not guarantee that you will receive early access to eligible direct deposits. You should confirm your Available Balance before attempting to make a withdrawal or purchase. Nonpayroll and tax payments may not be available for Early Pay. We may cancel Early Pay at any time and without notice. You may cancel Early Pay at any time by contacting your MidFirst personal banker or by calling us at 888.MIDFIRST (888.643.3477). Early Pay is not available for MidFirst payroll direct deposits to MidFirst Bank accounts. New accounts must be opened for 30 days to be eligible for Early Pay.

Visa® Rewards Plus

2 With Tinker Federal Credit Union's Visa Classic credit card, a 2.5% balance transfer fee will be assessed on balances transfers done outside of promotional or introductory periods.

3 For MidFirst Bank, your penalty rate will be up to 24.99% APR based on your creditworthiness.

Become a Member Today!

Now that you've seen the facts, let Advancial redefine your banking experience.

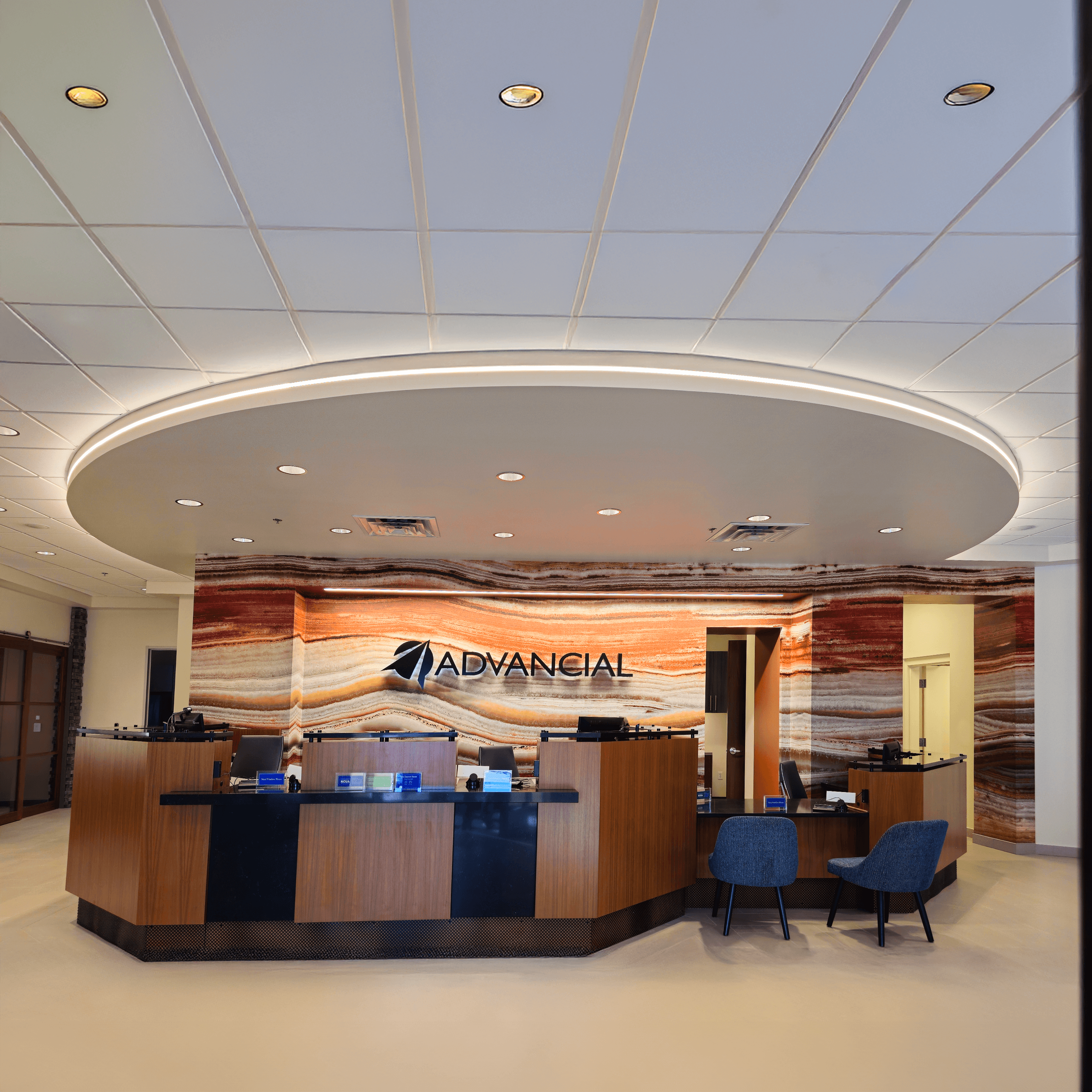

We're officially open!

Best Credit Union in DFW

Thanks to our incredible members, Advancial has officially been voted as the Best Credit Union in DFW!

Discover the Advancial difference and the many advantages of banking with the best!

Best of Acadiana

We're extremely proud of our deep roots in Lafayette and the surrounding communities. We've been honored to be named Best Bank in Acadiana seven years in a row, 2018 - 2024, Best Financial Planning Services for two years in a row, 2022-2023, and Best Mortgage Lending Company in 2023. The Times of Acadiana Best Of contest honors the top people, places, and businesses in Acadiana - all chosen by members of the local community!

Best of Allen

Advancial has been named the Best Credit Union in Allen in the Star Local Media Reader's Choice Awards for four years in a row, 2021 - 2024. Readers choose the best businesses in their community and we are proud to have been chosen in Allen!

Best of Katy

Advancial is honored to have been named the Best Credit Union in Katy for four years in a row, 2019 - 2022. The contest was not held in 2023. Nominations and votes were provided by the local Katy community and we are truly proud to have earned this recognition!

Best of Frisco

Advancial has been named the Best Credit Union in Frisco in the Star Local Media Reader's Choice Awards for three years in a row, 2022 - 2024. Readers choose the best businesses in their community and we are proud to have been chosen in Frisco!

Best of Mesquite

Advancial has been named the Best Credit Union in Mesquite in the Star Local Media Reader's Choice Awards for four years in a row, 2021 - 2024. Readers choose the best businesses in their community and we are proud to have been chosen in Mesquite!