Dinero Teens Savings

Build a firm financial foundation for your teen.

Introduce Your Teen to Finance with Advancial

Our Dinero Teens savings account establishes your teen's membership with Advancial. With competitive dividend rates and flexible account access, a Dinero savings account is the best savings account for your teen.

$5 minimum deposit to open

$100 minimum balance to earn dividends

No monthly service fee

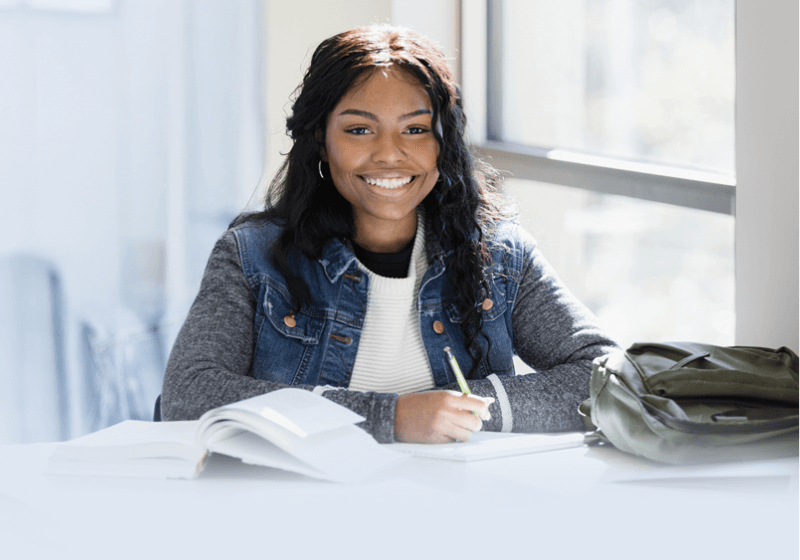

Carl R. Young Memorial Scholarship

Every spring, Dinero Teens members who are graduating juniors or seniors are eligible to apply for a chance to win one of four $2,500 scholarships. Named in memory of our longtime board member and volunteer, Carl R. Young, our hope is that this scholarship helps Advancial's young members succeed the way that Carl helped our credit union for so many years. Carl’s dedication and commitment to Advancial and our members was a vital part of our growth and success. His wisdom and long-term perspective helped guide and shape Advancial through many transitional moments in our history, and with this scholarship we honor his contributions and his memory.

The 2025 Carl R. Young Memorial Scholarship is now closed for submissions. Winners will be notified soon.More Dinero Options

Dinero Visa®

Frequently Asked Questions about

Dinero Teens Savings

We also offer the Dinero Teens Program for ages 13-18, which includes a savings account, checking account and the opportunity to apply for a Dinero Visa® at age 16. An adult is required to be a joint owner of the Dinero Visa.

- Withdrawals or transfers made at the ATM

- Transactions made in person at a branch

Dinero Teens Newsletter

Dinero Teens: Claim Your Cash — Don’t Leave Free Money Behind!

Dinero Teens: How to Ask for a Raise or Negotiate Your Salary

Dinero Teens: How to Build Credit Without Wrecking It